Insurance is one of the most important financial decisions you will ever make. It acts as a safety net for you and your family, protecting against unexpected events like accidents, illnesses, or financial loss. However, many people make mistakes when buying insurance that can cost them dearly in the long run. In this comprehensive blog, brought to you by Sunarzone Team, https://sunarzone.com/ we will cover the most common mistakes to avoid, provide practical tips, and guide you step by step to make the right insurance choices.

Why Insurance Matters

- Provides financial protection against risks like accidents, illness, or death.

- Ensures peace of mind for you and your loved ones.

- Helps you plan for long-term goals like education, retirement, or wealth creation.

- Acts as a safeguard for your assets like car, bike, home, and business.

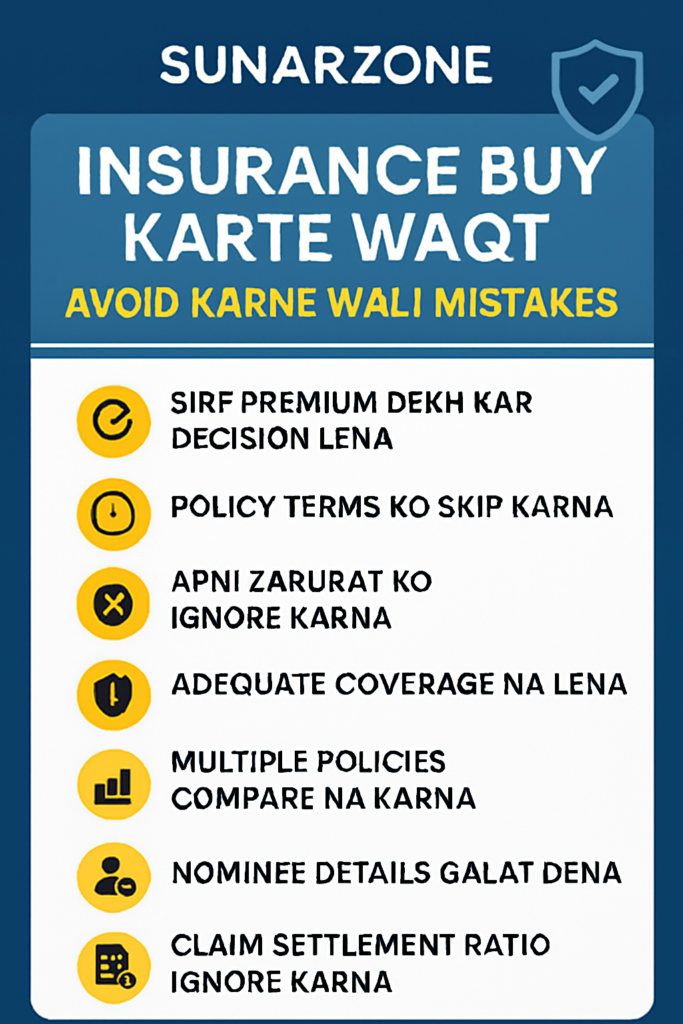

Common Mistakes People Make When Buying Insurance

1. Choosing Insurance Based Only on Premium

Many buyers look only at the premium amount and ignore the coverage. A low premium may seem attractive, but it often comes with limited benefits. Always balance affordability with adequate coverage.

2. Ignoring Policy Terms and Conditions

Skipping the fine print is one of the biggest mistakes. Every policy has exclusions, waiting periods, and claim rules. Not reading these carefully can lead to claim rejection.

3. Not Assessing Personal Needs

Insurance is not one-size-fits-all. Your age, income, family size, and lifestyle determine the right plan. For example, a young professional may need term life insurance, while a family with kids may prioritize health insurance.

4. Underinsuring Yourself

Choosing a low sum insured to save money can backfire. Medical costs and financial risks are rising. Ensure your coverage matches your actual needs.

5. Not Comparing Policies

With so many options available, failing to compare policies is a mistake. Use online tools to compare premiums, benefits, claim settlement ratios, and customer reviews.

6. Incorrect Nominee Details

In life insurance, nominee details are crucial. Incorrect or outdated information can delay or deny claim settlement.

7. Ignoring Claim Settlement Ratio

The claim settlement ratio shows how many claims a company successfully pays. A higher ratio means better reliability. Always check this before buying.

8. Buying Insurance Late

Delaying insurance purchase increases premiums and reduces benefits. Buy early to lock in lower premiums and wider coverage.

9. Overlapping Policies

Buying multiple policies without understanding overlaps can waste money. For example, having two health policies with similar coverage may not be efficient.

10. Relying Only on Agents

Agents may push policies that benefit them more than you. Always do your own research before finalizing.

Tips to Buy Insurance Smartly

- Assess Your Needs: Identify what risks you want to cover – health, life, vehicle, or property.

- Compare Plans: Use online comparison platforms to evaluate multiple options.

- Check Company Reputation: Look at claim settlement ratio, customer service, and reviews.

- Read Policy Documents: Understand exclusions, waiting periods, and claim processes.

- Update Nominee Details: Keep nominee information accurate and up to date.

- Buy Early: The younger you are, the cheaper the premium.

- Seek Professional Advice: Consult financial advisors if needed.

SEO-Optimized Keywords for Insurance Blog

To make this blog SEO-friendly for Sunarzone.com, we will use keywords strategically:

- Insurance mistakes to avoid

- Best insurance tips India

- Car and bike insurance guide

- Health insurance buying tips

- Life insurance mistakes

- Sunarzone insurance blog

- Financial protection tips

Detailed Sections for SEO and Readability

Car and Bike Insurance Mistakes

- Not renewing on time.

- Ignoring add-ons like zero depreciation cover.

- Not transferring NCB (No Claim Bonus).

Health Insurance Mistakes

- Choosing low coverage despite rising medical costs.

- Ignoring pre-existing disease clauses.

- Not checking hospital network.

Life Insurance Mistakes

- Confusing investment with insurance.

- Choosing endowment plans over term insurance without understanding.

- Not reviewing policy regularly.

Travel Insurance Mistakes

- Ignoring coverage for trip cancellations.

- Not checking medical coverage abroad.

- Buying at the last minute.

How to Make Insurance Work for You

- Plan Long-Term: Insurance is not just protection, it’s part of financial planning.

- Review Annually: Update coverage as your income and responsibilities grow.

- Integrate with Investments: Balance insurance with savings and investments.

Conclusion

Insurance is a powerful tool for financial security, but only if bought wisely. Avoiding common mistakes and following smart tips ensures you get maximum benefit. The Sunarzone Team https://sunarzone.com/ encourages you to make informed decisions, protect your family, and secure your future.

📍 Based in Delhi | 📱 WhatsApp: 9911166331 | 🌐https://sunarzone.com/